How does bicycle leasing work?

When you lease a bicycle, you actually rent a bicycle through your employer on a long term with an option to take it over at the end of the contract. In most cases, this involves a period of 3 years. When this period is over and the lease contract has ended, the driver has the option to buy the bicycle. With o2o, the residual value of the bicycle is usually 16% of the original value (exceptions are possible) and this value can be found in the Bicycle policy of your company.

When we talk about the cost of leasing a bicycle, we often speak about an all-in formula. Not only do you rent the same bicycle for 3 years, but you also make use of extra services like a breakdown assistance, insurances, maintenance budget and possibly also accessories. During the lease period, you as a driver will pay a monthly contribution for the use of your lease package (bicycle, insurance and accessories). As an employee, you usually pay this contribution via a part of your salary. Depending on your company’s bicycle policy, this contribution can also be paid via the holiday pay or an end-of-year bonus.

The basic idea behind leasing a bicycle is therefore quite similar to leasing a car. However, thanks to governmental economic measures, there are some notable differences, making the leasing of a bicycle much more advantageous than leasing a car.

Financial benefits of bicycle leasing

A lease bicycle is no BiK

When you lease a bicycle through the company, you don’t have to pay payroll tax or BiK (Benefit in kind) for this bicycle from the government. This means that, if you or someone in your family also wants to use the bicycle for private activities, you don’t have to pay any extra costs for this. Which is actually the case with a car. The only condition the government imposes is that you cycle to work on a regular basis. Exactly how much that is, is not mentioned anywhere. In most companies, the target is 20%. This means that on average, one out of five working days a year is spent commuting by bicycle. An achievable figure, right?

Attention, there is one main condition if you want to make use of these tax advantages: bicycle leasing has to be done via your employer. As a private person, you cannot lease a bicycle under these conditions, with the exception of self-employed entrepreneurs.

The financial benefit of gross salary exchange

It is of course nice to hear that you are exempt from a number of extra costs with such a lease bicycle, but how does this translate into reality? Well, when you start bicycle leasing, you make a commitment to make a monthly contribution for the use of your bike over a period of 3 years. Companies often choose to offer bicycle leasing on the basis of a gross salary exchange. In concrete terms, this means that the monthly contribution for your lease bicycle is first deducted from your gross salary and that your net salary is calculated afterwards. And that provides a very large financial benefit, because you are not taxed on this part of your gross salary. So you do make a monthly contribution for the lease package, but you actually only pay a part of it.

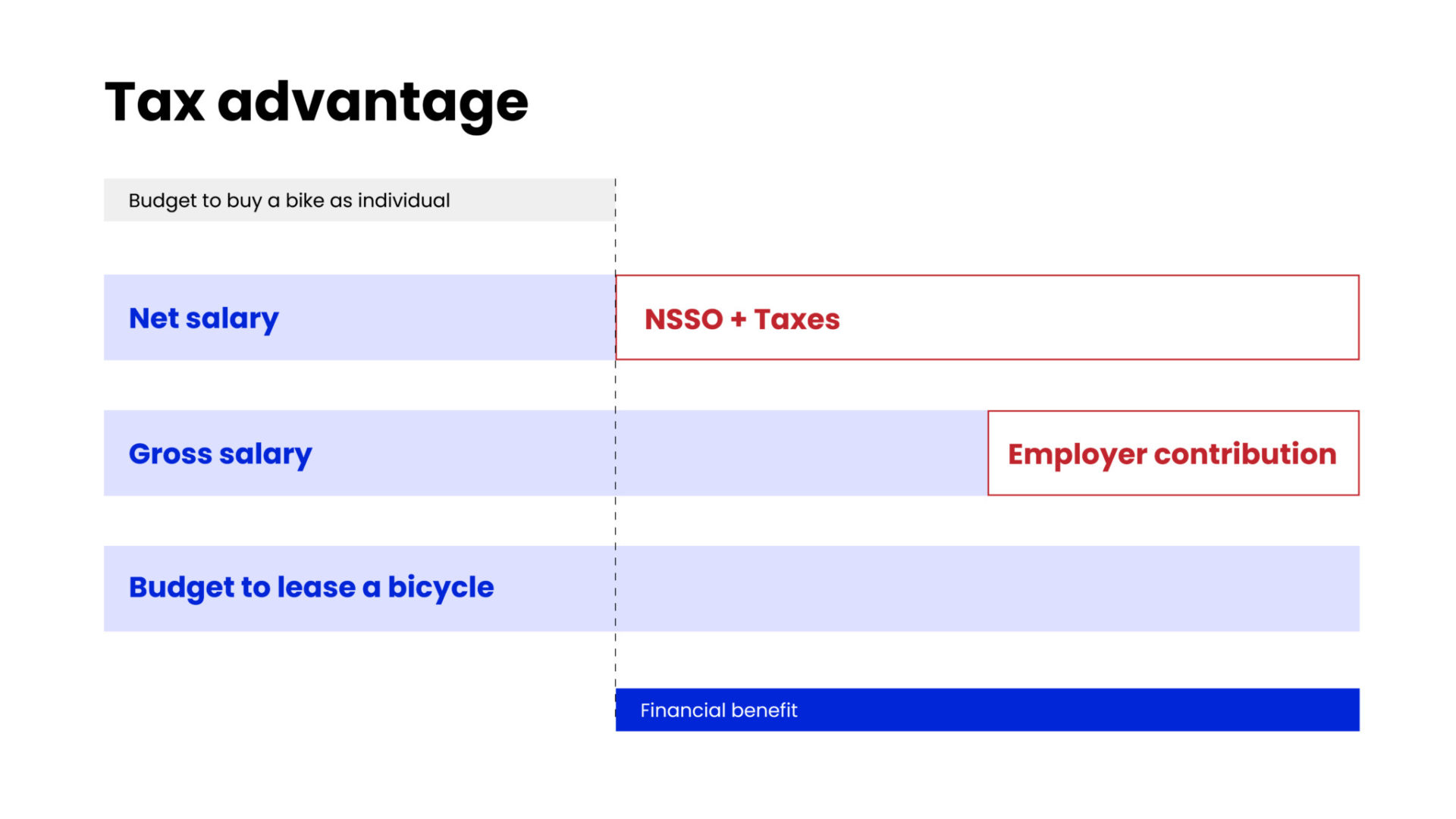

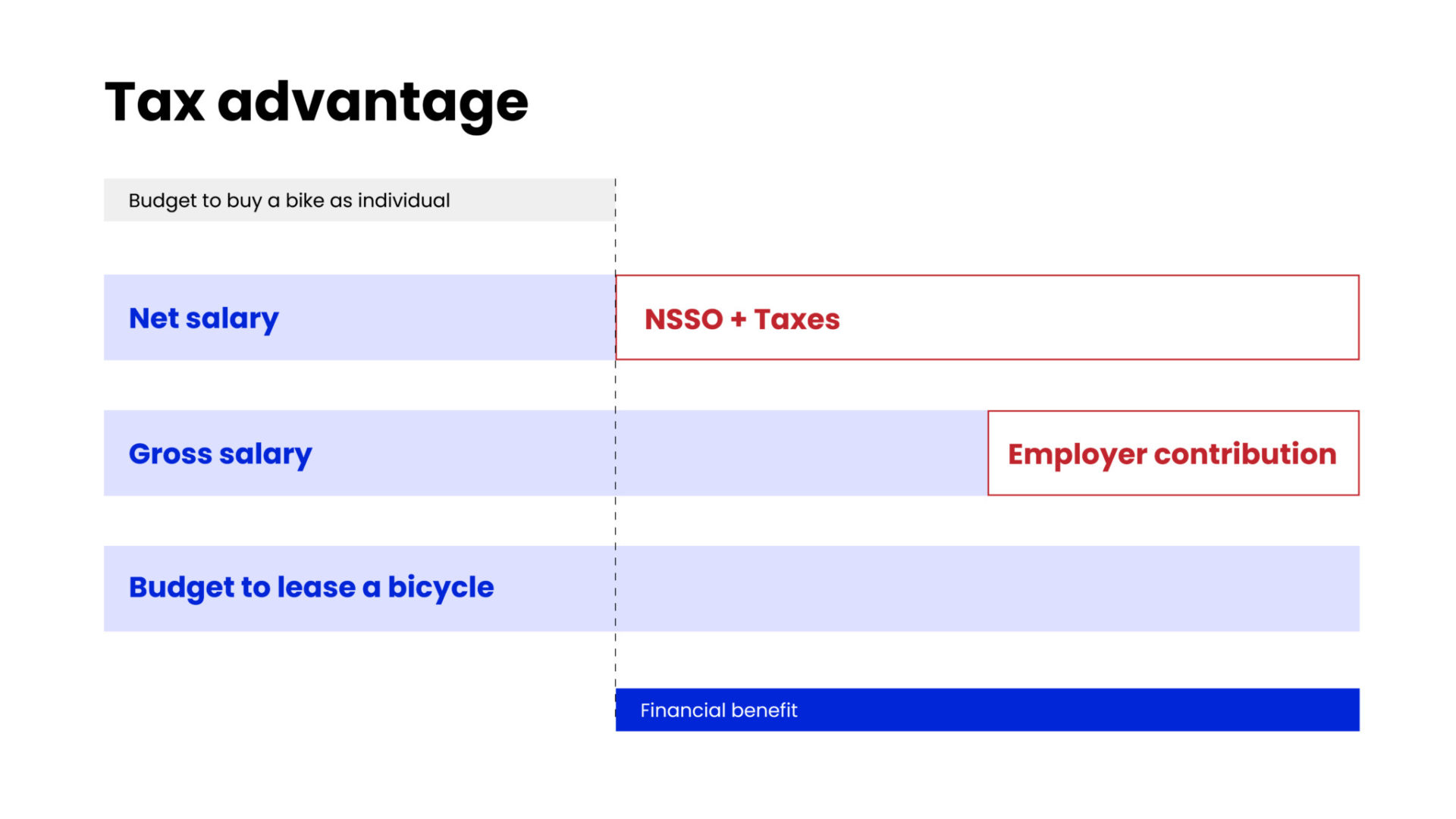

And that brings us to the next question: Is it more interesting to lease a bicycle through the company or to buy one yourself? The chart below shows exactly how this salary swap works and how it is best compared to a private purchase.

Normally, when you buy a bicycle, you do so via your net salary. Your net salary is the result of your gross salary minus social security and taxes. On top of that, your employer also pays employer’s contributions on your gross salary. By financing your lease bicycle through your gross salary, end-of-year bonus or gross bonus, these taxes are eliminated.

All this gives you a huge financial advantage, which means you have an extra budget for more advanced bicycles, such as electric bikes that often come with a high price tag. With bicycle leasing you can start dreaming of that new cool racing bike, electric cargo bicycle or fast speed pedelec…

Bicycle leasing by the end-of-year bonus

In a smaller number of cases, the wage exchange occurs on the basis of the end-of-year bonus. Settlement via the end-of-year bonus then takes place on a pro rata basis depending on the starting date. For example, if the lease starts in the middle of the year, half of the annual gross contribution is settled in the 1st year. The next 2 years, the full annual gross contribution will be settled via the end-of-year bonus. In the 4th year, half of the gross annual contribution will again be settled.

You might wonder what the impact of this gross salary swap or pay swap via your end-of-year bonus has on your pension? Read all about it in our blog on the minimum effect of bicycle leasing on your pension.

Calculate your own lease price?

There are many different types of lease bicycles, each with a different price tag. In addition, everyone’s salary is different and sometimes insurance is mandatory by the company (e.g. third-party insurance for speed pedelecs). It is therefore not easy to estimate exactly what the cost price of leasing a bicycle will be. No worries, here comes o2o to the rescue!

Using the o2o simulator you can easily simulate the estimated lease price of any bicycle. Does your employer already partner up with o2o? In your myo2o Biker account, you can make unlimited and exact simulations of your complete leasing package, accessories and extra services, before ordering. So you immediately know what contribution you will pay for which bicycle. And that’s useful, because as an employee you might still be hesitating between a few models. Say hello to your dream bike!

Want to lease a bicycle through your employer as well?

Does your company not yet offer bicycle leasing, but is there any interest? Please feel free to contact one of our Bike Lease Experts or convince your employer with our white paper “What is bicycle leasing?”.